how to pay indiana state sales tax

Fraudulent intent to evade tax -. Select Return Payment from the dropdown then click Next.

New Indiana Rv Sales Tax Law Takes Effect Rv News

Recap of Prepaid Sales Tax by Distributors Replaced by Form GT-103DR filed through INTIME ST-105.

. The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. Find your Indiana combined state and local tax. The discount varies depending on the size of what was collected.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. All businesses in Indiana must file and pay their sales and. When you filed your state return TT would have told you the various options as follows.

All retail merchants who registered for a sales tax permit in 2010 or later are required to filetheir sales tax returns online. 100 times 10 equals 10. County Rates Available Online.

How To Get Help Filing An Indiana Sales Tax Return. Find Indiana tax forms. Add the state sales tax 100 times 07 equals 7.

Sales Tax Collection Discounts In Indiana. The total cost of the hotel room is 100 plus 7 plus 10 or 117 per. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. Exemptions to the Indiana sales tax will vary by state. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Indiana businesses only need to pay sales tax on out-of-state sales if they have nexus in other states. For those who meet their sales tax compliance deadlines Indiana will offer a discount as well. Restaurants In Matthews Nc That Deliver.

Indiana businesses only need to pay sales tax on out-of-state sales if they have nexus in other states. Then figure the innkeepers tax of 10 percent. Claim a gambling loss on my Indiana return.

Indiana General Sales Tax Exemption Certificate. The base state sales tax rate in Indiana is 7. Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you.

Select the Individual I am here to make a payment for my personal income tax account payment type then click Next. Know when I will receive my tax refund. Nexus means that the business has a physical presence in another state.

Local tax rates in Indiana range from 700 making the sales tax range in Indiana 700. If you are stuck or have questions you can contact the state of Indiana directly at 233-4015 between 800 am. What to Do With the Taxes You Collect.

Indiana allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the. For those collecting less than. You must send the sales taxes that you charge to the appropriate state which is why it is important to keep detailed records of your.

How To File And Pay Sales Tax In Indiana Taxvalet

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

State Plans On Making You Pay Online Sales Tax Wish Tv Indianapolis News Indiana Weather Indiana Traffic

2022 State Tax Reform State Tax Relief Rebate Checks

Indiana Sales Tax Exemption Information For Transportation Companies

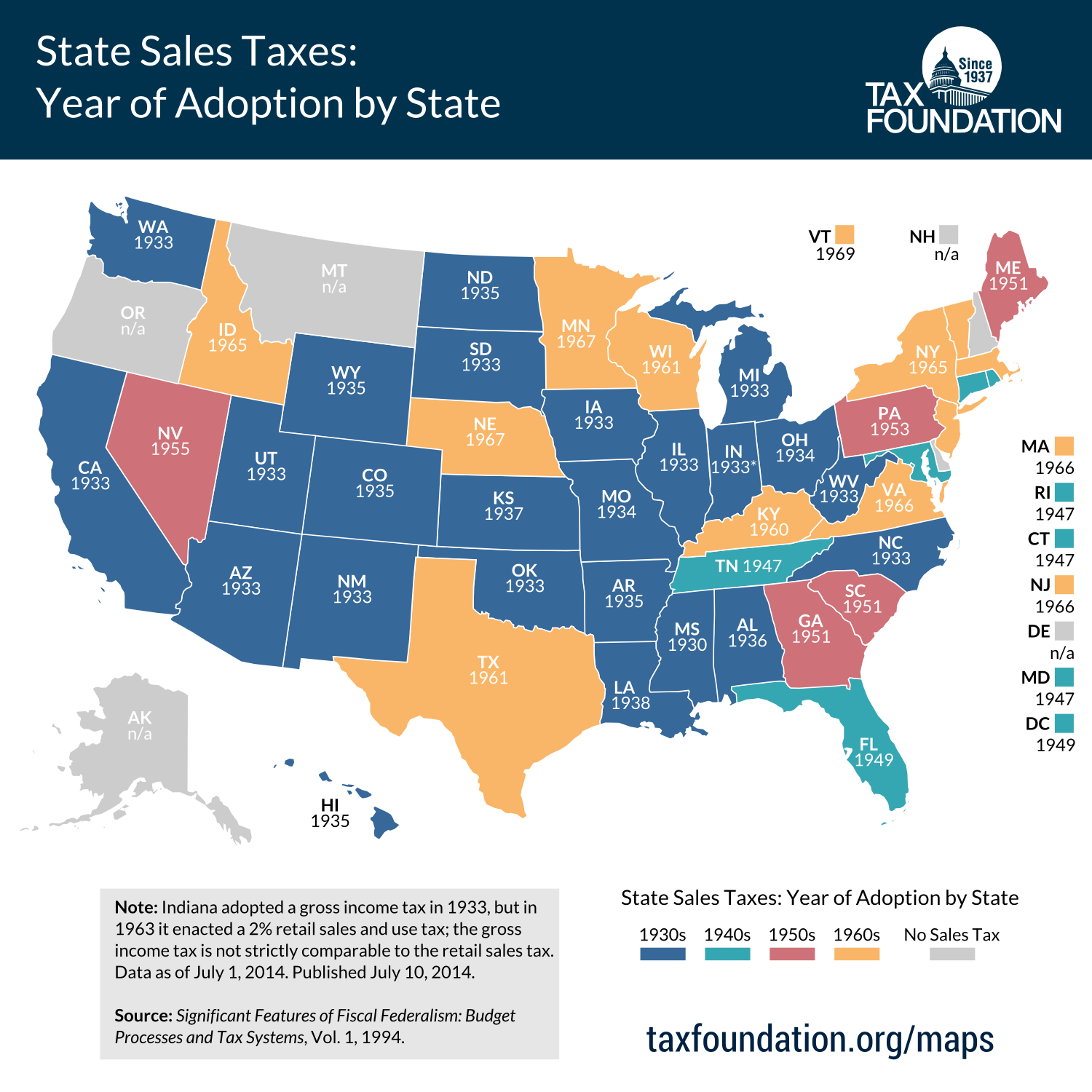

When Did Your State Adopt Its Sales Tax Tax Foundation

How We Got Here From There A Chronology Of Indiana Property Tax Laws

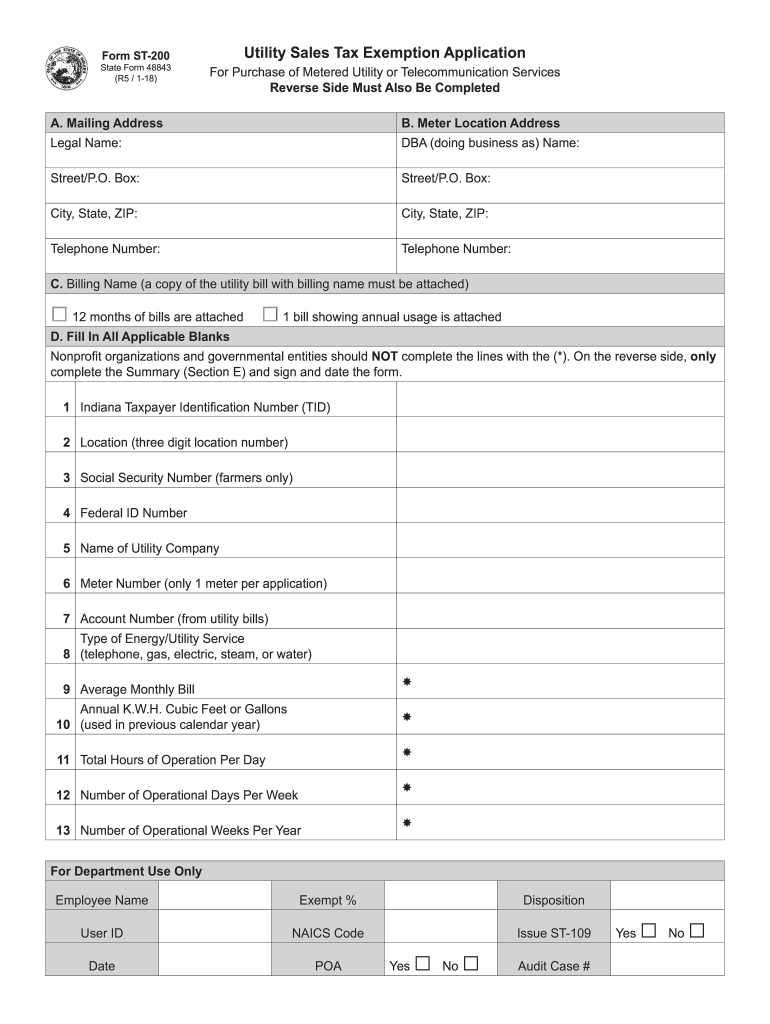

Indiana Utility Sales Tax Exemption Application Form St 200 Fill Out Sign Online Dochub

Sales Tax Requirements By State

Indiana Sales Tax Calculator Reverse Sales Dremployee

Business Guide To Sales Tax In Indiana

Indiana Sales Tax Exemption Certificate

Sales Tax Laws By State Ultimate Guide For Business Owners

Indiana Tax Sales Tax Liens Youtube

How Do State And Local Sales Taxes Work Tax Policy Center

States Moving Away From Taxes On Tangible Personal Property Tax Foundation